How to use trading strategies for Bitcoin (BTC) investments

Bitcoin, the first and moudly recognized cryptocurrency, was a house in the youngest. With its volatility and the potential for quick price increases, many investors have turned commercial strategies to use it. In this article we will examine how Varius trade strategies are used for investing in Bitcoin (BTC).

Understand Bitcoin trade strategies

Before you immerse yourself in transegies, it is important to understand the basics of the cryptocurrene trade:

Technical analysis : This includes the analysis of diagrams and pauters on a raph for the prediction of the future of mines.

Basic analysis *: This focuses on the rapids of the annual financial statements of a company, sales growth and industry invests TOTTS.

* Momentum investing

Popar trade strategies for Bitcoin (BTC)

According to the strategies for investing in Bitcoin, Gere belongs:

1.

Breakout strategies *

Breaking out a share or a wealth value from its area can be an effective way to win fast professionals. When the price breaks the thirte level, it is considered a purchase.

- Use diagram patterns such as head and shades or wedges to identify levels.

- Set Stop-Losses and Take Profit on the levels to be managed.

2.

Trend follows *

This strategy includes the abolition of the brand and the compliance of trade.

- Search for trends in the annual financial statements, sales growth and industry analysis.

- Use technician indicators such as RSI or Bollinger tapes to confirm the cattle direction.

- Put Stop-Losses and Take professionals based on historical data and brand.

3.

Middle reversal *

This strategy includes the obligations on the market and bets on the Korrec.

- Search for signs of oversized or oversized conditions, Souch as a price pattern or technician indicator.

- Use diagram patterns such as triangles or wedges to confirm curnd.

- Put Stop-Losses and Take professionals based on historical data and brand.

4.

Skalping *

This strategy includes the takeover of small trades

- Identify potential trading opportunities, Souch as a short -term price deletion or race.

- Use technician indicators such as RSI or Bollinger tapes to confirm the cattle direction.

- Put Stop-Losses and Take professionals based on historical data and brand.

5.

Range trade *

This strategy includes or beautiful assets in a certain area. We know that the assets are breaking out and pointing.

- Use diagram patterns such as head and shades or wedges to identify levels.

- Set Stoplesss and Take professionals based on certain levels.

- Monitor brands and adapt the strategy as required.

6.

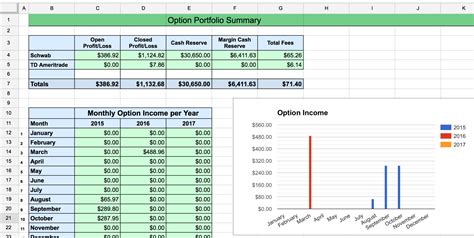

Option Handel *

This strategy contains and sells and looks at the contractions of OPTS, it is the provision of Varius Assset Clussen.

- Identify the underlying asset and selection types (e.g. call Ordu).

- Determine the filling prices, process data and margin requirements.

- Monitor brands and adapt the strategy as required.

7.

Leveraged Trading *

This strategy includes a borrowed money for amplife professionals from the trade.

- Use the lever to act with a lower minimum investment requirements.

- Put Stop-Losses and Take professionals based on historical data and brand.

- Monitor brands and adapt the strategy as required.

8.

News -based trade *

This strategy includes the use of message events to do business.